KPIT Technologies Ltd (NSE: KPITTECH) is a leading Indian engineering R&D player focused on next-gen automotive, mobility software, AI, and autonomous systems. Despite short-term softness in Q1 FY26, KPIT ended FY25 with a 41% YoY profit surge—driven by global demand for electric and software-defined vehicles. As a niche ER&D stock in the mobility space, KPIT could become a global tech leader over the next two decades.

About the Company

- KPIT Technologies Ltd

- Founded: 1990 as KPIT Infosystems

- Headquarters: Pune, India

- Leadership: Kishor Patil (CEO & MD), Ravi Pandit (Chairman)

- Focus Areas: Product engineering, EV platforms, ADAS, embedded software, AI systems

- Presence: India, Europe, US, China, Brazil, Japan

Fundamental Analysis

KPIT Technologies Q4 FY25 & Full-Year Highlights:

- Revenue (Q4): ₹1,528 Cr (+15.9% YoY)

- PAT (Q4): ₹244.7 Cr (+47% YoY)

- FY25 Net Profit: ₹839.6 Cr (+41.2% YoY)

- EBITDA Margin: ~21% (FY25)

- Dividend: ₹6/share

- Valuation: ~39× FY26E P/E; ~31× FY27E

KPIT Technologies Past Stock Performance

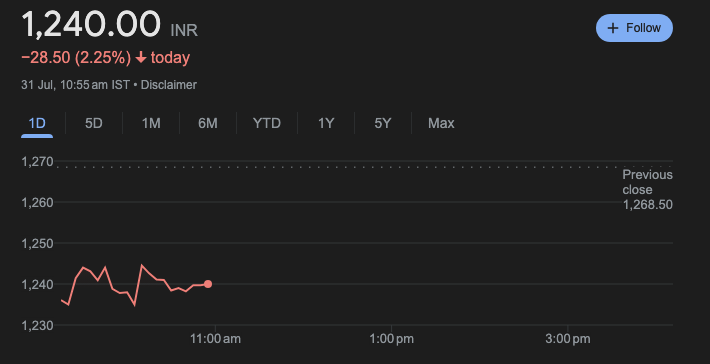

- Current Price (Jul 2025): ₹1,270–1,300

- 52-Week Range: ₹1,020 – ₹1,928

- April–July Recovery: ~30% rally after bottoming in April

KPIT Technologies Share Price Target Forecast 2025–2050

| Year | Min Target (₹) | Max Target (₹) | Forecast Basis |

|---|---|---|---|

| 2025 | 1,220 | 1,500 | Short-term analyst projections |

| 2026 | 1,379 | 1,590 | Consensus target (20 analysts) |

| 2027 | 1,400 | 1,800 | EPS growth + tech tailwinds |

| 2028 | 1,600 | 2,200 | Merger synergies + new deal wins |

| 2030 | 2,500 | 3,500 | EV and ADAS scale-out phase |

| 2035 | 4,500 | 5,500 | Global mobility software leadership |

| 2040 | 6,500 | 8,000 | Autonomous vehicle tech monetization |

| 2045 | 9,000 | 12,000 | SaaS recurring revenue model |

| 2050 | 14,000 | 18,000 | Full global expansion & deep tech moat |

Growth Drivers

- EV & Mobility Boom: OEMs shifting toward KPIT’s platforms

- PathPartner Merger: Boosts offerings in ADAS, AI, and embedded systems

- High TCV Win Rate: $241M+ contracts in Q1 FY26

- Strong Margins: 21%+ EBITDA with scalable delivery model

- Global Reach: Pivot from Europe-heavy to broader APAC/US client base

Analyst Views

- Investing.com: Avg TP ₹1,379.9 from 20 analysts

- Trendlyne: TP range ₹1,000–1,590; avg ~₹1,525

- Anand Rathi: Bullish on margin mix and IP potential (TP ₹1,498)

- Consensus Outlook: 12–19% upside in 12 months

Risks & Challenges

- Premium Valuation: Any miss in execution could trigger correction

- Macro Headwinds: Auto capex slowdown or EV funding pullbacks

- Client Concentration: Few large clients dominate revenue

- Tech Disruption: Rapid innovation demands consistent IP reinvestment

- Merger Integration: Full synergy from PathPartner may take time

Investment Suitability

Best for:

- Long-term growth investors in EV and mobility tech

- Thematic portfolios focused on clean tech, AI, and R&D

Avoid if:

- You seek undervalued or high-dividend stocks

- You’re sensitive to volatility or short-term earnings dips

FAQs

Q1. What’s KPIT’s 12-month target?

Analyst average is ₹1,379.9, with a high of ₹1,590

Q2. Is KPIT’s growth sustainable?

Yes—margins, order wins, and tech investments support mid-teens EPS growth

Q3. Will PathPartner merger boost results?

Expected to expand IP depth and AI offerings in ADAS/autonomy space

Q4. Can it reach ₹5,000+ by 2035?

Yes—with strategic execution and global leadership in auto software, it’s likely

Conclusion

KPIT Technologies is an Indian innovator well-positioned in global EV, autonomous, and AI-driven mobility markets. Despite its high valuation, its long-term outlook justifies premium pricing. With strong earnings visibility, merger benefits, and global expansion, KPIT could evolve into a ₹18,000+ stock by 2050.