GNG Electronics Ltd, the company behind Electronics Bazaar, is India’s largest refurbisher of laptops and desktops—and it’s quickly expanding into smartphones, tablets, and even global server refurbishing. After a blockbuster IPO in July 2025, the stock is under investor spotlight.

With 24%+ revenue CAGR, a sustainable business model, and partnerships with tech giants like HP and Lenovo, GNG is well-positioned to lead India’s refurbished electronics revolution.

About the Company

- Founded: 2006 (as Megha Defex)

- Core Business: Refurbishing and reselling laptops, desktops, smartphones, and servers

- Clients: B2B + retail, with strong OEM ties (HP, Microsoft, Lenovo)

- Operations: Serving markets in the US, EU, Africa, UAE, and India

- Business Model: Full-stack—from sourcing to after-sales warranty

GNG is built for the circular economy: promoting reuse over replacement, aligning with global sustainability trends.

Financial Performance (FY23–FY25)

| Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue | ₹1,138 Cr | ₹1,263 Cr | ₹1,411 Cr |

| PAT | ₹32.4 Cr | ₹52.3 Cr | ₹69.0 Cr |

| Net Margin | ~2.8% | ~4.1% | ~4.9% |

| Net Debt | ₹435 Cr → ₹115 Cr (post IPO) | ||

| Working Capital | ₹261 Cr (↑ to support volume growth) |

Profit nearly doubled in 2 years, and debt was slashed post-listing—a strong sign for future margins and stability.

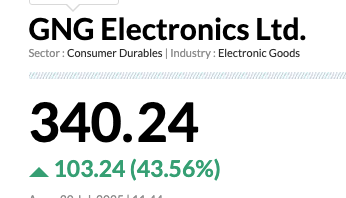

Stock Performance & IPO Highlights

- IPO Price Band: ₹225–237

- Listing Price: ₹349–355 (~50% premium)

- GMP Before Listing: ₹330+ (↑44%)

- Subscription Stats:

- QIB: 267×

- NII: 228×

- Overall: 148×

Massive investor interest confirmed strong institutional confidence and growth potential.

GNG Share Price Targets 2025–2050

| Year | Minimum (₹) | Maximum (₹) |

|---|---|---|

| 2025 | 330 | 360 |

| 2026 | 360 | 420 |

| 2027 | 450 | 600 |

| 2028 | 700 | 900 |

| 2030 | 1,000 | 1,500 |

| 2035 | 2,000 | 2,500 |

| 2040 | 3,000 | 4,000 |

| 2045 | 4,500 | 6,500 |

| 2050 | 7,000 | 10,000 |

Price forecasts are modeled based on EBITDA growth, improving margins, debt reduction, and global demand for affordable electronics.

Growth Drivers

- Massive Demand: Annual volumes projected to reach 6–8 lakh units by FY27.

- Cost Efficiency: EBITDA margins rose to ~9% in FY25.

- Debt Reduction: Interest costs reduced by over 75% post-IPO.

- Institutional Trust: 148× oversubscribed IPO with QIB dominance.

- Green Tech Trend: Refurbishment aligns with ESG investing and global circular economy mandates.

Expert Views

- Anand Rathi: “Subscribe for long term” rating.

- Broker Consensus (SBI, Bajaj, Canara): Fair P/E (~33×) and strong scaling outlook.

- Investing.com & Trendlyne: Fair value estimated at ₹340–360 in near term.

Analysts see near-term stability and long-term multibagger potential as growth compounds.

Risks to Watch

- Capital Intensive: Inventory and receivables drive high working capital needs.

- Narrow Margins: Net margin under 5% is still low.

- Execution Risk: Need to maintain quality while scaling fast.

- Competitive Pressure: Global refurb players and local startups are on the rise.

- Policy Risks: Import restrictions or e-waste rules could affect sourcing and operations.

Investment Suitability

Best for:

- Long-term growth investors in tech and ESG sectors

- Small-cap believers with high-risk tolerance

Not for:

- Dividend-focused or risk-averse investors

- Traders looking for quick returns

FAQs

Q1. Why did GNGL list at ₹350+ when the IPO was ₹237?

Strong grey market premium (GMP ~44%) and massive demand drove a ~50% premium listing.

Q2. GNG Electronics profits growing?

Yes—PAT grew from ₹32.4 Cr to ₹69 Cr in 2 years, with margins improving steadily.

Q3. What’s the 2030 price forecast of GNG Electronics?

Estimates range from ₹1,000–₹1,500 depending on execution and margin expansion.

Q4. Is this GNG Electronics safe stock for the long term?

It has potential, but investors should monitor margins, capital cycle, and global competition closely.

Final Thoughts

GNG Electronics Ltd (GNGL) offers investors a rare entry into India’s booming refurbished electronics space. With operational scale, solid financials, and strong IPO momentum, the stock could deliver solid long-term returns. However, margin pressure and capital needs remain key watch points.

If execution stays on track, GNGL could realistically cross ₹1,500 by 2030 and touch ₹10,000 by 2050—making it one of India’s most exciting small-cap tech stories.