Bank of India (BoI), a prominent public sector bank with 73.38% government ownership, delivered a solid 82% YoY profit growth in Q4 FY25, powered by treasury gains and healthy loan recoveries. With plans for ~12% loan growth in FY26 and improving asset quality, BoI is trading at just ~0.66× book value—making it one of the most attractively valued PSU banking bets in India.

About the Company

- Bank of India (BoI)

- Established: 1906

- Ownership: 73.38% held by Government of India

- Network: ~5,200 branches, 8,166 ATMs (as of Dec 2024)

- Core Areas: Retail banking, MSME, corporate credit, digital banking

Fundamental Analysis

Bank of India (BoI) Q4 FY25 Financials:

- Net Profit: ₹2,626 Cr (+82% YoY)

- Net Interest Income (NII): ₹6,063 Cr (+2% YoY)

- Other Income: +96% YoY

- Loan Book: ₹9.91 lakh Cr (YoY growth ~10.3%)

- Gross NPA: 3.27% | Net NPA: 0.82%

- Capital Adequacy Ratio (CAR): ~17–18%

Valuation:

- P/E Ratio: ~5.6×

- P/B Ratio: ~0.66–0.69×

- Dividend Yield: ~3.5%

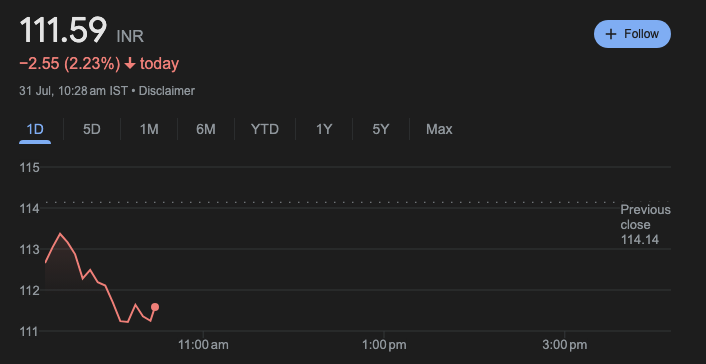

Past Stock Performance

- Current Price (July 2025): ₹113–118

- 52-Week Range: ₹90 – ₹130

- 1-Year Return: ~–1%

- 5-Year Return: ~+133%

Bank of India (BoI) Share Price Target Forecast (2025–2050)

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 110 | 126 |

| 2026 | 130 | 150 |

| 2027 | 160 | 180 |

| 2028 | 200 | 240 |

| 2030 | 300 | 360 |

| 2035 | 500 | 600 |

| 2040 | 800 | 1,200 |

| 2045 | 1,200 | 1,800 |

| 2050 | 1,800 | 2,500 |

These forecasts are based on growth in advances, improved profitability, and long-term PSU banking sector transformation.

Growth Drivers

- Credit Growth Momentum: ~15% YoY loan book growth

- Strong Asset Quality: Net NPA below 1%; PCR ~97%

- Profit Recovery: Boosted by treasury gains and fee income

- Capital Ready: High CAR enables lending without dilution

- Attractive Valuations: Undervalued vs peers; P/B below 0.7×

Expert Views

- Analyst Consensus (12-month): ₹126 average; ₹110–₹139 range

- TradingView Forecast: ₹127 median with a bullish bias

- EPS Growth Outlook: ~10–12% CAGR based on core banking improvements

- Market Sentiment: Strong dividend appeal and balance sheet cleanup in focus

Risks & Challenges

- Shrinking Margins: NIM down to ~2.61%

- Low Valuation Re-Rating: Price may stay stagnant if PSU rerating doesn’t occur

- Credit Risk: MSME/agri segment exposure still volatile

- Global Uncertainty: External shocks could impact earnings & investor appetite

Investment Suitability

Ideal for:

- Value investors

- Long-term PSU sector believers

- Dividend-focused portfolios

Avoid if:

- You seek high-growth, fast-moving stocks

- You rely purely on technical momentum

FAQs

Q1. What is Bank of India’s near-term target?

₹126 is the average analyst forecast over the next 12 months.

Q2. Is BoI’s asset quality improving?

Yes. Net NPA is below 1% with high provision coverage.

Q3. Can it hit ₹2,000+ by 2050?

Yes, provided credit growth, NIM recovery, and PSU sector re-rating persist.

Q4. What’s the dividend like?

At ~3.5%, it’s among the better yields in the PSU space.

Conclusion

Bank of India is a classic value pick in India’s PSU banking basket. Its improving profitability, strong asset metrics, and low valuation multiples suggest solid upside for long-term investors. While short-term growth may be capped, the journey to ₹2,500 by 2050 is achievable if India’s credit growth story holds up.